Main Menu

- Regions

- Banking

-

JPMorgan Expands Private Banking Presence in Dubai

September 4, 2024 -

Goldman Sachs to Trim Workforce

September 4, 2024 -

Algeria Joins BRICS New Development Bank

September 4, 2024 -

South Korean Banks Strengthen Capital Ratios in Q2 2024

August 28, 2024 -

BNY Mellon Fined for Swap Reporting Violations

August 28, 2024

- Investment

-

Boeing Avoids Strike with Tentative Union Deal, Shares Rise 3.7%

September 9, 2024 -

Citigroup Expects 20% Surge in Q3 Investment Banking Fees

September 9, 2024 -

UK Markets Drop Amid Global Economic Concerns, Nvidia Slump

September 4, 2024 -

Morgan Stanley Narrows Gap with Goldman Sachs in Equities Trading

September 3, 2024 -

Warren Buffett Sells $6 Billion Worth of BoA Shares

September 2, 2024

- Infrastructure

-

ITA Airways Secures $240 Million in Financing for New Aircraft

September 3, 2024 -

Saudi PIF Injects $1.5 Billion into Lucid to Boost SUV Production

August 6, 2024 -

Tanzania Launches Key Segment of Modern Railway Network

August 2, 2024 -

AIIB to Invest $1 Billion in African Projects

May 29, 2024 -

AfDB Commits $1.44 Billion to Boost Nigeria’s Infrastructure

May 29, 2024

- Tech

-

Mastercard to Acquire Cybersecurity Firm Recorded Future for $2.65bn

September 13, 2024 -

Middle Eastern Open Banking Firm Tarabut Acquires Vyne

September 4, 2024 -

SumUp Limited Bolsters Leadership Team

September 3, 2024 -

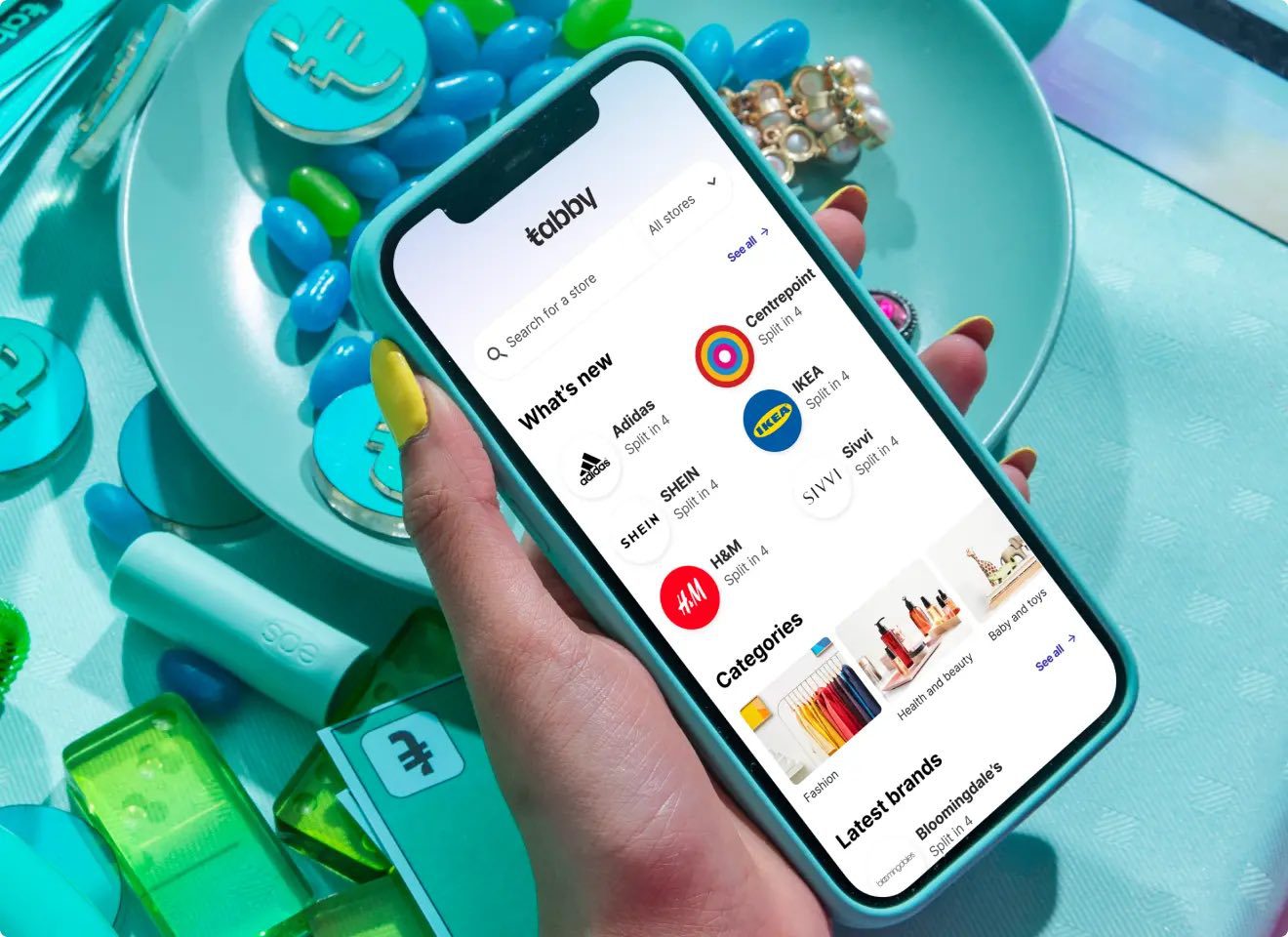

Tabby Acquires Saudi Digital Wallet Tweeq

September 3, 2024 -

Mastercard Launches Payment Passkey Service Pilot in India

September 2, 2024

- Featured

-

The evolution of digital assets in a digital age

July 26, 2024 -

Current Dynamics of Financial and Real Estate Markets: Insights and Strategies

June 28, 2024 -

Successful tax transformation for international organisations

June 28, 2024 -

Deuna: Changing Lives, Empowering Dreams

June 28, 2024 -

The Bigger The Waves, The More Expensive The Fish

June 28, 2024

- Videos

- Subscribe

- Magazine

- Awards

-