Main Menu

- Regions

- Banking

-

Warren Buffett Sells Off BoA Stake

October 8, 2024 -

Fiserv Granted Special Banking Charter in Georgia

October 7, 2024 -

Lloyds Banking Group Announces Share Buyback Update

October 7, 2024 -

HSBC and Tradeshift Unveil SemFi

October 7, 2024 -

Sterling Drops Following BoE Governor’s Remarks on Rate Cuts

October 3, 2024

- Investment

-

Reeves to Meet Top Banking Executives

October 8, 2024 -

Lloyds Banking Group Announces Share Buyback Update

October 7, 2024 -

Bursa Malaysia to Enhance Listed Company Value

October 3, 2024 -

European Auto Stocks Plunge as Automakers Issue Warnings

September 30, 2024 -

Credit Investors Seize Rare Opportunity in Euro Property Bonds

September 30, 2024

- Infrastructure

-

Microsoft, Blackrock partner on AI infrastructure

September 18, 2024 -

ITA Airways Secures $240 Million in Financing for New Aircraft

September 3, 2024 -

Saudi PIF Injects $1.5 Billion into Lucid to Boost SUV Production

August 6, 2024 -

Tanzania Launches Key Segment of Modern Railway Network

August 2, 2024 -

AIIB to Invest $1 Billion in African Projects

May 29, 2024

- Tech

-

Klarna taps Apple for Payment Offering

October 8, 2024 -

Fiserv Granted Special Banking Charter in Georgia

October 7, 2024 -

Switzerland and UK Sign Berne Financial Services Agreement

October 7, 2024 -

Visa Launches Pilot for New Commercial Payments Platform

October 7, 2024 -

Storfund Partners with TikTok Shop on New Solution

October 7, 2024

- Featured

-

Katch Investment Group: Leading the Way in Private Debt

September 30, 2024 -

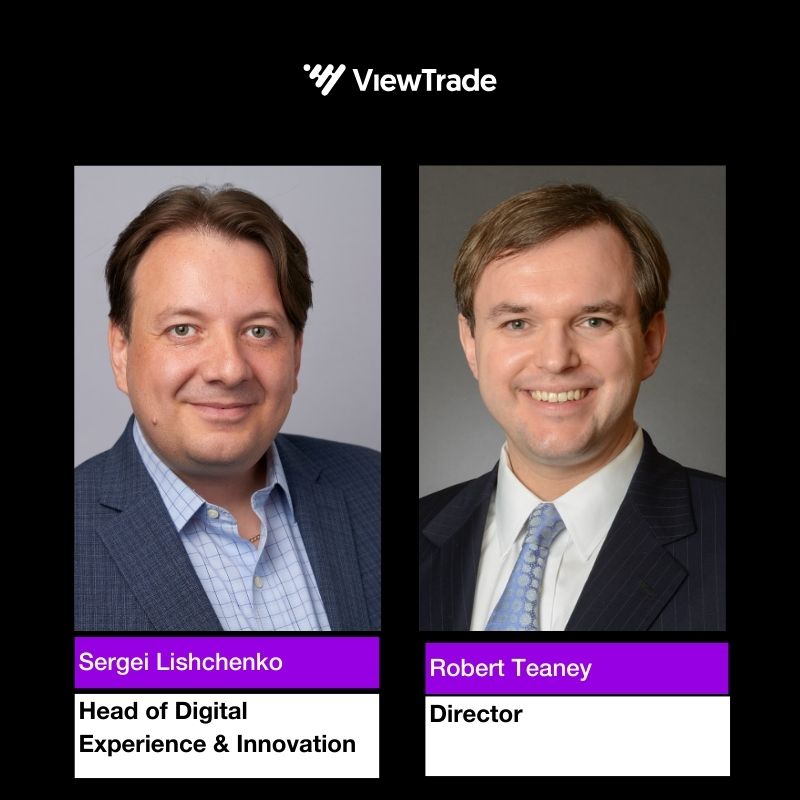

ViewTrade’s OneView: Redefining Financial Technology

September 30, 2024 -

The Secret to Success

September 28, 2024 -

Q&A: Co-Founder of Imandra Discusses the Future of AI

September 28, 2024 -

Digital Transformation in Talent Management by Applica Corp.

September 28, 2024

- Videos

- Subscribe

- Magazine

- Awards

-