Main Menu

- Regions

- Banking

-

Sterling Drops Following BoE Governor’s Remarks on Rate Cuts

October 3, 2024 -

Westpac to Sell Auto Finance Loan Book to Resimac

October 3, 2024 -

Commerzbank and UniCredit Enter Preliminary Talks

September 26, 2024 -

Scholz Warns UniCredit Against Commerzbank Takeover

September 24, 2024 -

BoE Holds Interest Rates at 5%

September 20, 2024

- Investment

-

Bursa Malaysia to Enhance Listed Company Value

October 3, 2024 -

European Auto Stocks Plunge as Automakers Issue Warnings

September 30, 2024 -

Credit Investors Seize Rare Opportunity in Euro Property Bonds

September 30, 2024 -

Asian Markets Rally as China Stimulus Hopes Fuel Global Optimism

September 26, 2024 -

Wall Street Hits Record Highs After Fed Rate

September 19, 2024

- Infrastructure

-

Microsoft, Blackrock partner on AI infrastructure

September 18, 2024 -

ITA Airways Secures $240 Million in Financing for New Aircraft

September 3, 2024 -

Saudi PIF Injects $1.5 Billion into Lucid to Boost SUV Production

August 6, 2024 -

Tanzania Launches Key Segment of Modern Railway Network

August 2, 2024 -

AIIB to Invest $1 Billion in African Projects

May 29, 2024

- Tech

-

Bank of England and FCA Launch Digital Securities Sandbox

October 2, 2024 -

Mastercard Finalises Acquisition of Minna Technologies

October 2, 2024 -

OpenAI Faces Structural Overhaul, Sam Altman to Receive Equity Stake

September 26, 2024 -

Nasdaq Expands FinTech Footprint in LatAm with Nubank Partnership

September 23, 2024 -

PayRetailers Expands Footprint into Africa

September 20, 2024

- Featured

-

Katch Investment Group: Leading the Way in Private Debt

September 30, 2024 -

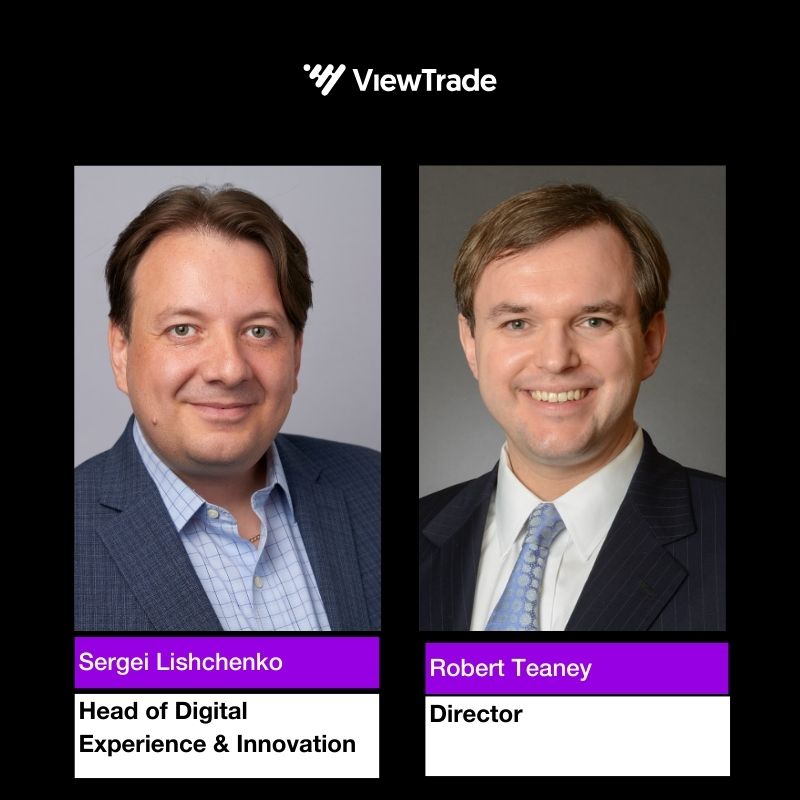

ViewTrade’s OneView: Redefining Financial Technology

September 30, 2024 -

The Secret to Success

September 28, 2024 -

Q&A: Co-Founder of Imandra Discusses the Future of AI

September 28, 2024 -

Digital Transformation in Talent Management by Applica Corp.

September 28, 2024

- Videos

- Subscribe

- Magazine

- Awards

-